The Definitive Guide to Feie Calculator

Table of ContentsGetting My Feie Calculator To WorkFacts About Feie Calculator UncoveredHow Feie Calculator can Save You Time, Stress, and Money.Little Known Facts About Feie Calculator.Some Ideas on Feie Calculator You Should KnowThe Facts About Feie Calculator UncoveredFascination About Feie Calculator

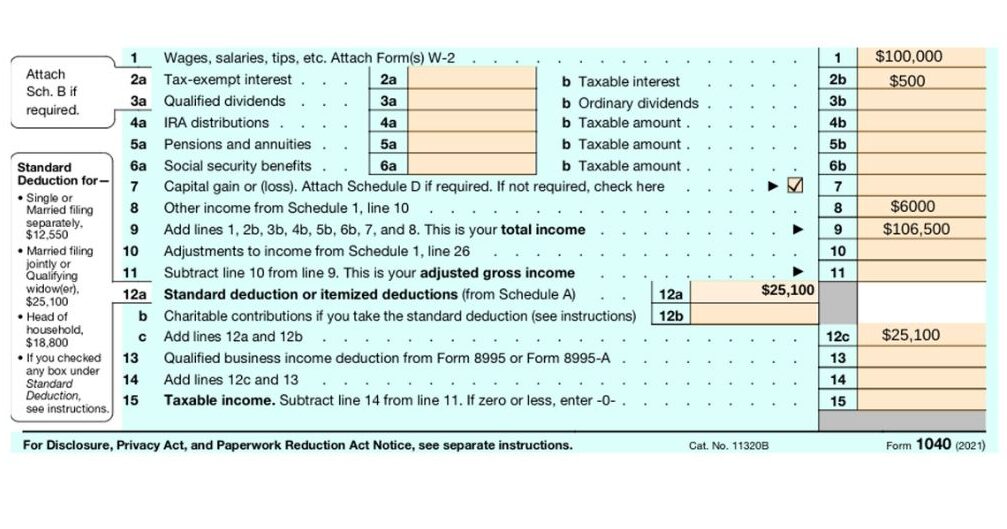

If he 'd often taken a trip, he would instead complete Component III, noting the 12-month duration he met the Physical Presence Test and his traveling background - Bona Fide Residency Test for FEIE. Step 3: Coverage Foreign Income (Component IV): Mark earned 4,500 per month (54,000 annually). He enters this under "Foreign Earned Revenue." If his employer-provided housing, its worth is likewise consisted of.Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Considering that he resided in Germany all year, the percent of time he lived abroad throughout the tax is 100% and he goes into $59,400 as his FEIE. Finally, Mark reports total wages on his Form 1040 and goes into the FEIE as a negative amount on time 1, Line 8d, decreasing his taxed earnings.

Selecting the FEIE when it's not the most effective option: The FEIE may not be excellent if you have a high unearned earnings, make even more than the exemption restriction, or reside in a high-tax nation where the Foreign Tax Obligation Credit (FTC) may be more beneficial. The Foreign Tax Credit Scores (FTC) is a tax obligation decrease technique often made use of in combination with the FEIE.

Getting My Feie Calculator To Work

deportees to offset their U.S. tax financial obligation with international income taxes paid on a dollar-for-dollar reduction basis. This implies that in high-tax nations, the FTC can frequently eliminate united state tax obligation debt entirely. The FTC has constraints on qualified tax obligations and the maximum insurance claim amount: Eligible taxes: Only income taxes (or tax obligations in lieu of income tax obligations) paid to foreign governments are qualified (Digital Nomad).

tax obligation liability on your international income. If the international tax obligations you paid surpass this limit, the excess foreign tax obligation can typically be brought ahead for as much as ten years or returned one year (using a changed return). Maintaining accurate documents of international income and tax obligations paid is for that reason crucial to calculating the appropriate FTC and maintaining tax obligation compliance.

expatriates to lower their tax obligation liabilities. If an U.S. taxpayer has $250,000 in foreign-earned earnings, they can leave out up to $130,000 using the FEIE (2025 ). The staying $120,000 might then be subject to tax, but the U.S. taxpayer can possibly apply the Foreign Tax obligation Credit history to balance out the taxes paid to the international nation.

9 Simple Techniques For Feie Calculator

Initially, he sold his U.S. home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his spouse to assist fulfill the Bona Fide Residency Test. In addition, Neil safeguarded a long-term residential or commercial property lease in Mexico, with plans to at some point purchase a home. "I presently have a six-month lease on a home in Mexico that I can extend another 6 months, with the intent to acquire a home down there." Nevertheless, Neil mentions that acquiring home abroad can be challenging without first experiencing the location.

"We'll absolutely be beyond that. Even if we come back to the United States for doctor's consultations or company telephone calls, I doubt we'll invest more than thirty day in the US in any type of given 12-month period." Neil stresses the significance of strict tracking of united state brows through. "It's something that individuals need to be truly diligent regarding," he claims, and recommends expats to be mindful of typical mistakes, such as overstaying in the united state

Neil bewares to tension to united state tax authorities that "I'm not carrying out any service in Illinois. It's simply a mailing address." Lewis Chessis is a tax consultant on the Harness platform with substantial experience aiding U.S. citizens navigate the often-confusing world of international tax find out this here compliance. Among the most typical misunderstandings among united state

The Ultimate Guide To Feie Calculator

tax obligation return. "The Foreign Tax Credit rating permits people functioning in high-tax nations like the UK to offset their U.S. tax obligation liability by the quantity they've currently paid in taxes abroad," claims Lewis. This ensures that deportees are not tired twice on the same income. Those in low- or no-tax nations, such as the UAE or Singapore, face additional obstacles.

The possibility of lower living costs can be tempting, however it frequently comes with trade-offs that aren't instantly apparent - https://www.edocr.com/v/baoqoy8v/feiecalcu/feie-calculator. Housing, for instance, can be more cost effective in some nations, but this can mean jeopardizing on framework, security, or accessibility to reliable utilities and services. Economical buildings may be situated in locations with inconsistent web, restricted public transport, or unstable healthcare facilitiesfactors that can dramatically affect your day-to-day life

Below are several of one of the most often asked inquiries about the FEIE and other exemptions The Foreign Earned Earnings Exclusion (FEIE) allows united state taxpayers to leave out approximately $130,000 of foreign-earned revenue from government earnings tax, minimizing their united state tax obligation obligation. To receive FEIE, you need to meet either the Physical Presence Examination (330 days abroad) or the Authentic House Test (prove your key residence in a foreign country for a whole tax obligation year).

The Physical Existence Examination requires you to be outside the U.S. for 330 days within a 12-month duration. The Physical Existence Examination likewise requires united state taxpayers to have both an international income and an international tax obligation home. A tax obligation home is specified as your prime area for business or employment, no matter your family members's home. https://feie-calculator.jimdosite.com/.

Things about Feie Calculator

An income tax obligation treaty between the U.S. and another country can assist protect against dual tax. While the Foreign Earned Earnings Exemption reduces gross income, a treaty may provide fringe benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a required declare U.S. people with over $10,000 in international economic accounts.

The international gained revenue exclusions, sometimes referred to as the Sec. 911 exemptions, omit tax on earnings made from working abroad.

How Feie Calculator can Save You Time, Stress, and Money.

The tax obligation benefit omits the income from tax obligation at lower tax obligation rates. Formerly, the exemptions "came off the top" lowering earnings topic to tax at the top tax obligation rates.

These exemptions do not exempt the incomes from US tax but simply give a tax decrease. Note that a solitary person functioning abroad for every one of 2025 who made concerning $145,000 without any various other revenue will have taxed earnings lowered to no - successfully the same solution as being "free of tax." The exemptions are calculated each day.

If you participated in company conferences or workshops in the US while living abroad, earnings for those days can not be excluded. For US tax it does not matter where you keep your funds - you are taxed on your around the world income as an US person.